Brazzaville Summit Sends a Message of Continuity

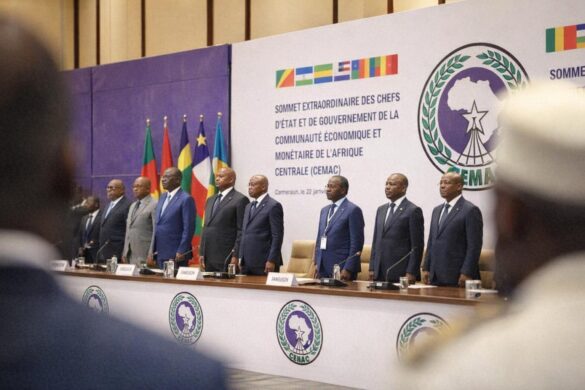

As previously announced, the heads of state of the Central African Economic and Monetary Community (CEMAC) met in Brazzaville on January 22, 2026. In their final communiqué, they confirmed “the continuation of the macroeconomic stabilization strategy initiated since 2024.”

A careful reading of the text suggests the meeting did not unveil any major structural reforms. Nevertheless, the document sends a clear signal to investors: continuity, predictability, and a willingness to stay the course at a time when sovereign risk in Central Africa is being reassessed upward by some parts of the market.

Analyses from BEAC, CEMAC Commission, and IMF Frame Decisions

The discussions were based on assessments presented by the Bank of Central African States (BEAC), the CEMAC Commission, and the International Monetary Fund (IMF). Participants reaffirmed that fiscal discipline remains the central policy priority, with budgets needing to stay aligned with IMF-supported programs.

The communiqué also maintains administrative modernization as a priority. It highlights “the establishment of single treasury accounts and the digitalization of public finances” as practical tools aimed at reducing leakage, strengthening cash management, and improving the credibility of fiscal reporting over time.

Monetary Credibility: Reinforced Central Bank Independence and Supervision

For financial markets, the renewed emphasis on the BEAC’s independence is presented as a key anchor for monetary credibility. In a region where confidence can shift rapidly with external conditions, reaffirming the central bank’s autonomy is often seen as a stabilizing commitment rather than a symbolic line.

The Brazzaville meeting also instructed “the strengthening of banking supervision by the Central African Banking Commission (COBAC).” The goal, according to the communiqué, is to contain risks related to banks’ high exposure to sovereign debt—an issue investors are closely monitoring across the monetary union.

BDEAC’s Role Highlighted for Financing and Transformation

Beyond stabilization, leaders also emphasized the need for development financing. The communiqué calls to “strengthen the role of the Development Bank of the Central African States (BDEAC) in financing and the structural transformation of CEMAC economies.”

For private sector observers, this focus is important as it links macroeconomic discipline to long-term growth capacity. The text does not detail new instruments, but it indicates that regional institutions want the BDEAC to be part of the solution as investment needs remain substantial.

Growth, Deficits, and Market Arithmetic

In Brazzaville, four heads of state attended—Central African Republic, Gabon, Equatorial Guinea, and the Republic of Congo—alongside two finance ministers representing Cameroon and Chad. Together, they noted that “CEMAC’s average growth has remained limited to 2.1% over the past five years,” below the region’s population growth rate.

Participants indicated that this trend reduces the zone’s ability to generate sustainable external surpluses. After an aggregate budget surplus in 2023, the sub-region returned to a deficit in 2024 and 2025. Projections cited at the meeting indicate a risk of exceeding 3% of GDP in 2026 without credible fiscal adjustment.

Foreign Reserves Remain the Key Dashboard for Investors

The extraordinary summit also confirmed that the single most-watched indicator by investors is the trajectory of foreign exchange reserves. For a fixed exchange rate system, reserve levels are not an abstract metric; they are a real-time test of policy credibility and external resilience.

BEAC data referenced during the meeting indicates that between March and November 2025, reserves fell by 1,335.7 billion CFA francs (approximately $2.4 billion), equivalent to about one month of imports. This decline fuels questions about sustainability and risk premiums, even as officials emphasize the safeguards of the framework.

2026: Markets Seek Execution, Not Slogans

The BEAC’s message for 2026, reflected in the summit’s tone, is that markets will reward operational implementation more than political statements. In practice, this means measurable progress on fiscal consistency with IMF-supported programs and the effective repatriation of export revenues.

Across the CEMAC zone, stabilizing reserves should remain the primary confidence test. The Brazzaville communiqué, by focusing on continuity, supervision, and public finance modernization, offers investors a clearer benchmark—while implicitly acknowledging that credibility will be judged on execution.